Renting vs. Buying – Which Is Better in Retirement?

Category: Retirement Real Estate

April 29, 2016 — One of the biggest considerations most Americans face is determining if, and when, it makes sense to buy a home. In retirement, however, the question becomes a different one: “Should I remain a homeowner?” For all Americans, one recent study by Trulia.com found it is more cost effective to buy than rent. But what about for retirees? Trulia found that it is 41.8% cheaper for retirees to buy than rent in all major US metros. The issue is not quite that simple though, as there are emotional and practical considerations as well as financial ones.

We were very pleased that Trulia reached out to Topretirements for this article, providing us with custom data for our Top 10 Most Popular Places to Retire. This data, presented further down in the article, will give you good insight into the buy vs. rent conundrum for many top retirement spots. You can read their entire rent vs. buy report, “Best Places for Retirees to Rent or Buy.”

Some of Trulia’s general findings:

· Nationally, buying is slightly cheaper than renting compared to last year. Locally, buying ranges from being 52.3% cheaper than renting in New Orleans versus just 14.4% cheaper in Honolulu.

· For retirees, buying is cheaper than renting in all major metros by 41.8% At the city level, Florida offers the best deals on purchasing a home over renting, and popular retirement communities such as Sun City, Ariz., and The Villages, Fla., offer some of the widest margins.

. The 2 U.S. Metros where it is most cost effective to buy rather than rent are both in Louisiana – New Orleans and Baton Rouge, where it is 53% and 52% respectively cheaper to rent. Florida had 2 Metros on the Top 10 Buy vs. Rent list from Trulia, Fort Lauderdale and West Palm Beach.

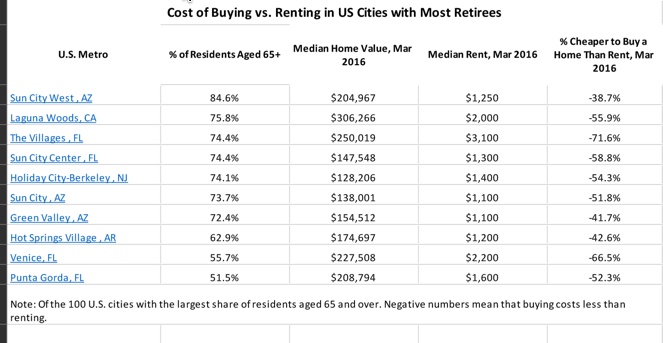

Cost of renting vs. buying in U.S. cities with highest 65+ population

The chart below contains some great data on the cost of homes, rents, and the buy vs. rent comparison. The Villages in Central Florida offers the greatest advantage to buyers, where it almost 72% cheaper to own than rent.

The Topretirements Top 10 Most Popular Places to Retire

Here is information on home prices and rental costs for the Top 10 Most Popular Places to Retire at Topretirements.com

If You Don’t Have, Or Don’t Like Your Heirs, Renting Might Be the Better Choice in Retirement

The Trulia rent vs. buy equation takes into account the value of the equity in your home when you sell. The reality for most retirees is that their retirement home will likely be last home they’ll purchase, so any remaining equity in the house will be passed on to heirs. But what if you don’t have any, or don’t care to pass on anything to the ones you do have?

Omitting the value of home equity in the rent vs. model, it’s actually more expensive to buy a retirement home than rent one in 98 of the 100 cities with the largest 65+ populations. The only two cities where it’s cheaper to buy are the The Villages, Fla. and Danville, Va., where it’s 14% and 7.1% cheaper, respectively. See more at trulia.

A word about Trulia’s methodology

Trulia used a number of financial assumptions to calculate its renting vs. buying figures. You should know them to see if all apply to your situation. Some of them include:

– Quality-adjusted measure of home prices and rents looked at median home value and rent in March 2016 in each of the largest 100 metros.

– Total monthly costs of owning and renting, including mortgage payments, maintenance, insurance, and taxes.

– Future total monthly costs of owning and renting, taking into account expected price and rent appreciation, as well as projected inflation.

– One-time costs and proceeds including closing costs, down payment, sale proceeds, and security deposits (Trulia assumes retirees won’t move as often as younger people).

– Net present value, which reveals the opportunity cost of using money to buy a house instead of investing it.

Here is where you can see the full Trulia Methodology

Pros and Cons

There are also other factors beyond the economic ones. For example, most people believe that owning real estate is important. They want to leave something for their heirs. And they want to outlive their money. Here are some of the renting vs. buying advantages and disadvantages we have discussed in prior articles (see Further Reading below).

Pros of Buying a Home:

– Pride of ownership- the American Dream

– Possible appreciation

– Tax breaks

– Independence and permanency – fix it up the way you want it

– Cheaper (maybe)

– You are in control and don’t have to look for a new place to live (very important in snowbird rentals)

Cons of Buying a Home

– Prices might go down

– Hard, if not impossible, to get a mortgage

– Risky: fire, tornado, hurricane, flood, neighborhood goes bad

– Interest rates go up

– Tax benefits could be taken away

– If you don’t like the state, town, or neighborhood – or your grandchildren move – it’s easy to pull up stakes.

Healthier people more likely to own than rent

We are not exactly sure of all the reasons why (other than economic), but among adults aged 65 years or older, 34% of renters reported fair or poor health compared with 19% of homeowners in that age group. (Source – QuickStats: Percentage of Adults with Fair or Poor Health, by Home Ownership Status and Age Group — National Health Interview Survey, United States, 2014. MMWR Morb Mortal Wkly Rep 2016;65:385. DOI: http://dx.doi.org/10.15585/mmwr.mm6514a8 ).

For further reading:

Buy, Rent, or Stay

Rental Frustrations Lead to the Snowbird Dilemma: Rent or Buy

How to Find a Vacation Rental for Your Retirement

How Anyone Can Find an Affordable Warm Winter Retirement

Your Best Place to Retire Might Be a Rental

Comments? Have you explored the idea of buying vs. renting? What did you decide to do – and what factors did you consider? Are you happy with your decision? Could you ever see yourself renting?

Comments on "Renting vs. Buying – Which Is Better in Retirement?"

Joanne Hice says:

This was the exact problem we faced when we moved to Green Valley, AZ. My plan was to rent because I was tired of being a homeowner and wanted someone else to have the pain and agony. However, during visits to research what was available, we decided it would be better to buy for many reasons. First of all, the real estate bargains were there thanks to the 2008 real estate crash. Renters were not open to us keeping our cat and we were not going to get rid of her as she is a family member. There were other things such as we can change the colors on the walls and window coverings if we want. We can decorate the patio and front yard as we want (within HOA guidelines). We found an excellent bargain on a 1,500 sf townhome built in 2003 in a beautiful neighborhood very well kept. In 2003, when it was built it was $160K. The prices went up and I think the highest one went for was 225K before the crash. We paid $132K and it came fully furnished even though we did donate a lot of the furnishings to charity because they weren't our style. Monthly payments are $648 and that includes taxes insurance, and interest. We do have to pay insurance based on what the insurance adjuster appraised it at which was $207K which is fine with us. The prices of the neighboring townhomes have gone up since we bought 10 months ago and are selling from $150K to $165K. If it hadn't been for the real estate crash, we (and our realtor) estimate these townhomes would have been in $250K - $265K now. To rent a comparable townhome would be $1,200 and up per month. We love being able to decorate the yard with the desert Southwest look. Neighbors have complimented us on the changes we have made. I have never owned a home as well built and as well insulated as this one. So, before making the decision, do as we did. Research the pros and cons for the area and your personal situation. For us, buying was the best decision. I might add that here in Green Valley, insurance and taxes are only 1/3 to 1/4 of what we were paying on a slightly smaller house in Texas.

Gabriela says:

We own our main home, but rent 2-3 months during the winter. The cost is less than property taxes, utilities and maintaince would be. We have noticed rents increasing and availability is often limited both in Florida and Arizona. Also owning gives one the opportunity to develop a sense of community. Any thoughts?

David M. Lane says:

We retired early and at age 57 relocated to Florida where we have owned two bedroom/two bath condominiums with our latest in Winter Haven. This condo has 1400 sq.ft., covered parking, gated, heated swimming pool and is close to city center, grocery, library, medical care and we have a commanding view of the chain of lakes from our fourth floor location. Taxes and fees are both quite reasonable. We are now in our mid seventies and thinking that renting might be a better option should something happen to one or both of us. Our children who live in New Jersey and Manhattan have indicated they would not be interested in living in our condo in their future. We have looked and looked in this great city and are unable to find a suitable rental apartment that comes close to what we have here in the Lakeridge condominium we presently own. None of the rental apartments offer walk in/stand alone shower, none offer covered parking and none have a swimming pool that is heated to 83 degrees all year long. We can't do better here in this central Florida location than the condo we own. Even if we settled for a rental apartment that did not offer what we have here it would cost us considerably more in monthly costs. Maybe some new rental apartments will be built with all the stuff we want at a rental price we would be comfortable with. We are probably dreaming. I guess condo living in Winter Haven will continue to be our fate.

Tom Pritchard says:

For snowbirds, it's a matter of how much time they are going to spend in the winter escape location. Many who buy tend to stay longer than renters plan to. Some owners choose to buy investment properties, in anticipation of appreciation, to generate a revenue flow. New York has a Star Exemption, enhanced for seniors, on school taxes. Florida has a Homesteading exemption which only requires six months of residence to qualify how snowbirds between these two states can only claim an exemption in one state, unless the deeds on the respective properties are held by exclusive parties (not jointly). As retirees receiving NYS government pensions, our pensions income is not taxed nor is the first $25,000 of our respective deferred compensation withdrawals, so effectively we pay no income tax in NYS, however Florida has no state income tax so it really doesn't make any difference for us. The Homesteader exemption on our residence in Florida is better than our Star exemption was on our NYS property so we switched our state of residence to Florida. I know some folks from Wisconsin who did the same thing. It might actually make more sense for us to sell our property in NYS and rent a place just for the summer months and we would not be restricted to one place and could visit various areas in and outside of the U.S. for the costs of property ownership which we currently incur in NYS (Property taxes, insurance, and utilities). The sale of our NY property could fund quite a few years of seasonal rentals, and we have not yet tapped into Social Security or our IRAs.

Laurie says:

I think that it is important when purchasing a home in retirement to choose a home that not only fits your needs at the time of purchase but, to anticipate your needs perhaps later on down the road - i.e. a one story home instead of one with stairs. That way you will be able to get more use out of your home for a longer period of time. Great comparison of renting vs. buying. I definitely think you can save money with buying, but it needs to make sense for the individual. Thanks for sharing!

Justin says:

I live in Beaufort and for a lot of people I know a mortgage is less each month than rent is by a pretty good margin.

Mary11 says:

Comparison calculator for buying or renting. My result was as long as the rent was low it showed that renting was a better choice than buying in the long run. For example if you plan to purchase a home for $100,000 and you can rent for less than $800 it's better to rent. You can do that living in coastal Oregon.

Rebecca Braun says:

Mary,

Would you mind being a little more specific about the "coastal Oregon" area you are referring to? I am very doing a lot of research to find an area I can settle into for a long period of time. The west coast is attractive to me for a number of reasons, but I can't seem to hone in on anyplace with the $800 rent category and still have something that works for the lifestyle I'd like to have. Widowed and almost 62 years old; still wanting to work - have been doing executive assisting in education for a very long time, but would like to change that. Currently working in a conference/retreat center doing guest services to take a break from desk work for a year or so while I regroup.

Thank you!

Florence says:

On the forum under Real Estate Trends there are some comments about buying vs renting. I'm thinking that as a "younger" retiree buying is the way to go. As we get older though, the idea of renting may be a better idea as it is easier and less complicated for all involved.

Mary11 says:

Rebecca,

what I meant by coastal Oregon was the coastal towns starting from the north such as Astoria all the way south to Brookings. I have done alot of research concerning towns near the coast to going inland such as Medford and Roseburg. Rents start around $600 for a 1 BR. If you plan on working though I would recommend Eugene, it's the 2nd largest city in Oregon. I lived in Portland for 8 yrs and honeymoon was at the Newport area. We are looking for a smaller town atmosphere because we currently live in Sandiego. You actually can buy a condo right on the beach for $100,000 or buy a Mfg home on your owned lot starting at $70,000 and HOA is only $155 monthly. So needless to say I am having a hard time deciding. .....lol.....good luck and if you have further questions contact me anytime.

Admin says:

This is a good discussion about renting - let's keep it going. For those interested in living in Oregon you might also want to visit our Dueling States article on the Pacific Northwest: http://www.topretirements.com/blog/great-towns/dueling-retirement-states-the-pacific-northwest-or-and-wa.html/

says:

We are going to rent for the first time just as snowbirds this winter although thinking this will be a good chance to see if we like renting long-term in the future when we downsize. What I didn't expect while we went through this was how hard it was to find the perfect place that accepted pets, or if they do how many floors up did we want the condo to be for taking them out for walks several times a day. Renting with pets takes a little more research to find.

Mary11 says:

Jemmie, you are so right! When looking for a rental your numbers are about 25% of apts that will allow pets. Buying with pets is a better option because you also are not limited with the number of pets you can have.

Kate says:

When I was relocated to Charlotte for a few years, I considered renting for a few years as I approached retirement age, leaving myself more flexibility. I found that nice 2-3 bedroom apartments in this area were quite expensive. The break-even on the rent vs. buy calculators was about 3 years. By the time I finished calculating tax breaks for ownership and anticipated closing costs (in & out), it looked more like 3-1/2 to 4 years before home ownership was cheaper for me. I chose to purchase, and at this point my monthly cost (real estate tax, HOA fee, mortgage, lawn care) for owning are about $650/mo less than it would have been costing me for the rental - plus I can hang pictures, have a pet, paint walls etc. That calculation doesn't include utility differences (3,000 sq. ft. home vs. 1,200 sq. ft. rental), homeowners ins. vs. renters' ins., or a storage unit that I would have had to rent for an apartment, or any lost revenue I would have earned (after tax) on the $200K that I applied to the purchase price. Sound complicated? Yes, a lot went into the decision to buy instead of rent. Ultimately, although the calculators were helpful to support my decision to buy, I think I elected to purchase a home for emotional reasons instead of financial ones. I still wanted to put down roots and have a "nest" that I could personalize. I probably would have gone with a rental if I was only going to be here for less than that 2-3 years though, or if my health wasn't great and I didn't want to have to do anything relating to home ownership.

Marynb says:

I currently own my 3 bedroom multilevel condo and I am trying to calculate whether to sell it, save the proceeds, and rent something much smaller. Condo fees alone here are 675./month and real estate taxes are outrageous. Several posters referred to a calculator. Where do I find it? Also, does anyone know of a place with affordable rents in Southern New England? Thanks.

Rich says:

Renting with pets can be a trial. Similar to vacationing with pets, just in one place. But we have vacationed with our two dogs all over the country for more than 8 years, so it is doable. We've stayed in hotels, motels, cabins, and rented homes -- whatever we needed or could get. Ground floor access is really a big help. Having a fence or other appropriate barrier is an absolute blessing! And having pets that are not a nuisance to others may be the true key to success...

Kate says:

Marynb There are mutiple rent vs. buy calculators online, if you search for rent vs buy. Realtor, Moneyrate, trulia, zillow, mortgage sites and even Yahoo have them. I tried several, when I was going through the process. The results were similar.

LocoBill says:

We have rented homes and condos the past 5 years in Florida during Jan-March. We have a 60lb dog who goes with us. You are limited where you can rent but it can be done. We found the Orlando area to be pet friendly and took our dog many places. Any outdoor eating area is ok for dogs and there are a lot of them. Most of the the LaQuinta hotel chain is pet friendly and the hotels are pretty nice.

Staci says:

We always thought buying, with cash, was the way to go. As we get older, I can see where renting may be am option. The chores that we were able to take care of with the help of our still at home children, now have to be "outsourced" , adding up to big $$$$$. Even when there are no emergencies, and face it, when you own a home, there are always emergencies, the cost of routine maintenance and the difficulty involved in doing it yourself can be downright depressing. Maybe the solution would be to slowly downsize, though in home ownership the above issues would continue though on a smaller scale. It would be nice to have someone else responsible for those problems.....

Laney says:

I've been a happy renter for many years. At first it was because house prices were rising fast but not as fast as stock values & I decided to put my money in stocks. Now, all these years later, I think of rent as prepaid home maintencance! Of course, the better the landlord, the better the maintenance but at least I don't have to climb on a ladder and no longer own a snow shovel. Laney

Staci says:

Laney

Just wondering are you renting an apartment or house? If an apartment, is iit in a complex or private home?

thanks

Laney says:

Staci, I live in a 300+ apartment complex at the moment. It was as good a landing spot as any when I moved to Portland but definitely is not my first choice for living style. My favorite was renting a house in a Del Webb community where I had access to all the facilities plus "prepaid maintenance." I've also lived in a privately owned 4 plex. laney

areti11 says:

Laney, I've been doing research on King City outside of Portland. It's like a Del Web community. I just saw a rental for $880 monthly.

Laney says:

areti11 - where did you see the listing for rental in King City for $880/month? Laney

Laney says:

areti11 - I just found the listing on Craigs List. No units available. The rent is considerably lower than anything else anywhere nearby. I wonder why. Laney

areti11 says:

Laney, I'm guessing it was probably one of the older models and the owner has passed away or moved on and needs help paying with the HOA.

DeyErmand says:

I have to say that buying is going to beat renting IF the home is paid in full when you are retired. (Maintenance, insurance, all utilities and local services on your property and taxes will still be cheaper than renting.) The decision to own versus rent is very much a lifestyle decision, something a calculator doesn't have the ability to figure into it's computation. It has to do with where you want to retire, and if you can no longer afford/manage the upkeep of a home by yourself. I read somewhere that whether renting or buying, retiree's move twice after retirement.

Louise says:

Renting has its benefits but is also has a lot of cons too. As a child, my parents rented. Most of the time you are at the mercy of the landlord. In one situation we lived in a two family house. The landlord lived downstairs but moved upstairs and we moved into the first floor. The miser had the only thermostat so at times we had to beg for him to turn the heat up. The house was probably 100 years old with no insulation. Then they wanted to move downstairs and we moved upstairs. Of course he had the thermostat rewired so it only worked downstairs then. Then he decided to sell the house and we had to move. Then we moved to a four family building upstairs. The old couple downstairs passed away and we moved downstairs. The landlord was always lurking around and would come into the apartment while we were all out. He also controlled the heat and had a lock box on the thermostat. He finally decided to sell the units as condos so we had to buy or get out. My Mother had it and was SICK of renting. There was a tag sale next door and the family was selling the house. My Mom looked at it and told my Dad she wanted to buy it and they did. LOTS of work was needed but she loved it and they lived there for probably 30 years. Renting can be the pits!

There is also noise associated with renting as far as your neighbors above, beside and under you. Music, arguments, screeching kids, crying babies, parties. Kids running on floors above you or riding trikes on hardwood floors. Water leaks from above or beside you. Barking dogs, barking all day long.

areti11 says:

Check out what Mary 11 came up with using the comparison calculators, it makes sense.

Louise says:

Mental health can't be calculated. If you have a bad landlord and bad neighbors your life will be hell. You can pay $2,000 a month or $800 a month rent, doesn't matter. Bad landlords and bad neighbors are a deal breaker.

Not to mention too many rules. Don't get me wrong, rules are good most of the time. But if you have animals, the landlord may restrict size and amount of dogs. Cats too. Some places won't allow any animals. Some places charge extra monthly fees to allow an animal. Can't paint walls colors you might like. You might be limited to amount of car parking spots. There are a lot of things to consider when renting. Things you never had to deal with as a home owner.

Bubbajog says:

One thing for sure, bad neighbors can be a nightmare whether you own or rent. If you rent it is a lot easier to move. If you own, the situation becomes more difficult: You always have to be prepared for major face offs with the real bad neighbors.

Louise says:

I happened to notice in the local paper a landlord who was offering an apartment for rent. The description seemed to indicate it was a two family house, lower floor with yard. The price was $1,750 plus 2 months security! OMG! To walk in the door that cost $5,250! Where on earth do people with low paying jobs find that kind of money? Granted they probably wouldn't rent this apartment but even a $1,000 apartment requires the same one month down and two months security and that would be $3,000! Still a LOT of money! I complain about my taxes which are over $5,000 a year and could move down South and pay like $1,500 for the same house I have here. But renting is just hard to swallow! I know a lot of people rent until they are comfortable in an area to buy and that is smart. Or if you are an executive who is in a new job and not even sure if you will like the job, why buy. There are tons of reasons to rent for sure. Elderly people cannot keep up with a house. But if they have the money they can hire people to do work. If they can afford it. It is a real problem for elderly people. My husband was a saint and took care of my Mom's property for years and years after my Dad passed away. He plowed snow, mowed the grass, trimmed the bushes, removed the leaves in the fall, roto tilled her garden, cleaned her gutters, put up Christmas lights, did as many repairs as he could and what he couldn't do she hired people. He put in a sidewalk, built a deck for her. So many things no one could even imagine and taking care of OUR house too! However, we have no children to do anything for us, so renting could be in our future too as much as it wouldn't set well with me! I will avoid it at all costs.

DeyErmand says:

Renting when you are young is a cheaper option while you save some money. Rentals in Senior hi rises are by income but have rules and regulation with long waiting lists. I have seen some nice ones but if you have savings, a pension and 401K you are going to find a cheaper rental elsewhere. The article points out the cost of rent realistically in certain areas for retirees. Those are the averages in most cities. Most landlords want first month, last month and security deposit before you can move in. And if you are not happy in that apartment, you are locked into a rental agreement for a period of time where you are obligated to stay or pay in full to break the agreement. Your rent generally is going to be raised 2% per year. Renting a place for $800 dollars a month would make me investigate why the rent is lower. Renter beware! Just like buying a home, check out the neighborhood, check the police blotter, and talk to those currently living in that town.

DeyErmand says:

Example of buying a home with cash from Zillow Rent VS Buy Calculator.

Cost: After 4 years, your total cost of home ownership (down payment, mortgage, taxes, etc.) for a $100,000 home in Eugene, OR would be $130,632. Your total cost to rent would be $64,874. Renting leaves you with $65,758 in your pocket (including the money you didn't spend on a down payment).

Gain: After 4 years, if you buy, your home will have $120,684 in equity (available to you when you sell). However, if you instead rent and invest your down payment and the other money you save, at a 6% return rate it will earn around $18,554 in 4 years.

Bottom line: Looking at your gross costs, equity and investment potential, it's better for you to buy than rent if you plan to live in your home more than 1 year and 5 months.

DD says:

I know when I had a house payment my property taxes and house insurance was included in my mortgage payment and never was the total higher than the current rent. Being a woman I had to hire a fix it man for most everything but painting. I think through the last 30 years I may have spent 30K including replacing all appliances once. Which comes to an extra $84 dollars for each month I have lived here. It costs me now monthly (without a house payment) taxes, utilities and insurance, $684 a month. Local rent on a 1 bedroom apartment with utilities included is $1200. I would be nuts to go sale and rent a place!

areti11 says:

Where do you live DD? Where I'm moving to the rent will be between $600 -$800. And if you were planning to purchase a home for $100,000 and live in it for at least 20 yrs, it would still be cheaper to rent. Btw, that's for southern Oregon. I still haven't decided which I prefer but at least you have better options there.....

DD says:

areti11 , I live in Sharon PA about 70 miles Northwest of Pittsburg, PA. The Shenago River runs thru the middle of town, and the cost of living is very affordable. The Shenago Valley Shuttle bus serves all of Mercer County. We are a small College campus town, home to Sharon Regional Hospital. We have four seasons, and some heavy snow at times.

ella says:

Info. on a Furnished Rental. My husband and i sold all our furniture and moved with 13 boxes to NE Tennessee in September. We wanted to travel light as we are not sure of where we'll settle, and not sure of how many times we'll have to move before making the decision. I have much to say on that, but won't do it now as it's not my purpose in posting the following information on furnished rentals. What i do want to do is share what the two furnished rentals we've lived in were furnished with.

We didn't take many items, like full flatware sets, more than 2 cooking pots, etc. as i assumed there would be flatware as well as other necessary items. And there are, but they are all cast-offs. Mismatched and scant flatware, used up non-stick cookware, pots without lids, knives that bend when cutting an orange, colanders that don't drain but pour out a ton of water when emptying the contents. I think you get my drift. All the junk goes into furnishing the house. I thought this was important to share, as i'd have taken more (although, maybe not a lot more) had i known this.

I'd also like to add that the first place, a 100 year old farmhouse in Greeneville, TN, was so filthy that we had to move out in one week. This was after spending most of that week cleaning. Then we moved into a lovely apartment in Jonesborough, TN. Although this was rented as a luxury unit, it has also has needed much ongoing cleaning. Both units were being rented by individuals, so i don't know if this is typical.

I hope this is helpful. I wouldn't have known any of it had i not been living through the experience. I can't wait to be a homeowner again, however, we still have much traveling to do before making that determination.