Looking for a State Where Your Savings Go the Furthest?

Category: Financial and taxes in retirement

June 25, 2026 — You can probably guess the states that are the most expensive to retire. Yep – Hawaii, Alaska, California, Massachusetts, Rhode Island, New Jersey, Connecticut, and New York are almost always atop those lists. But to find the states where your retirement savings go the furthest – that is not always that easy.

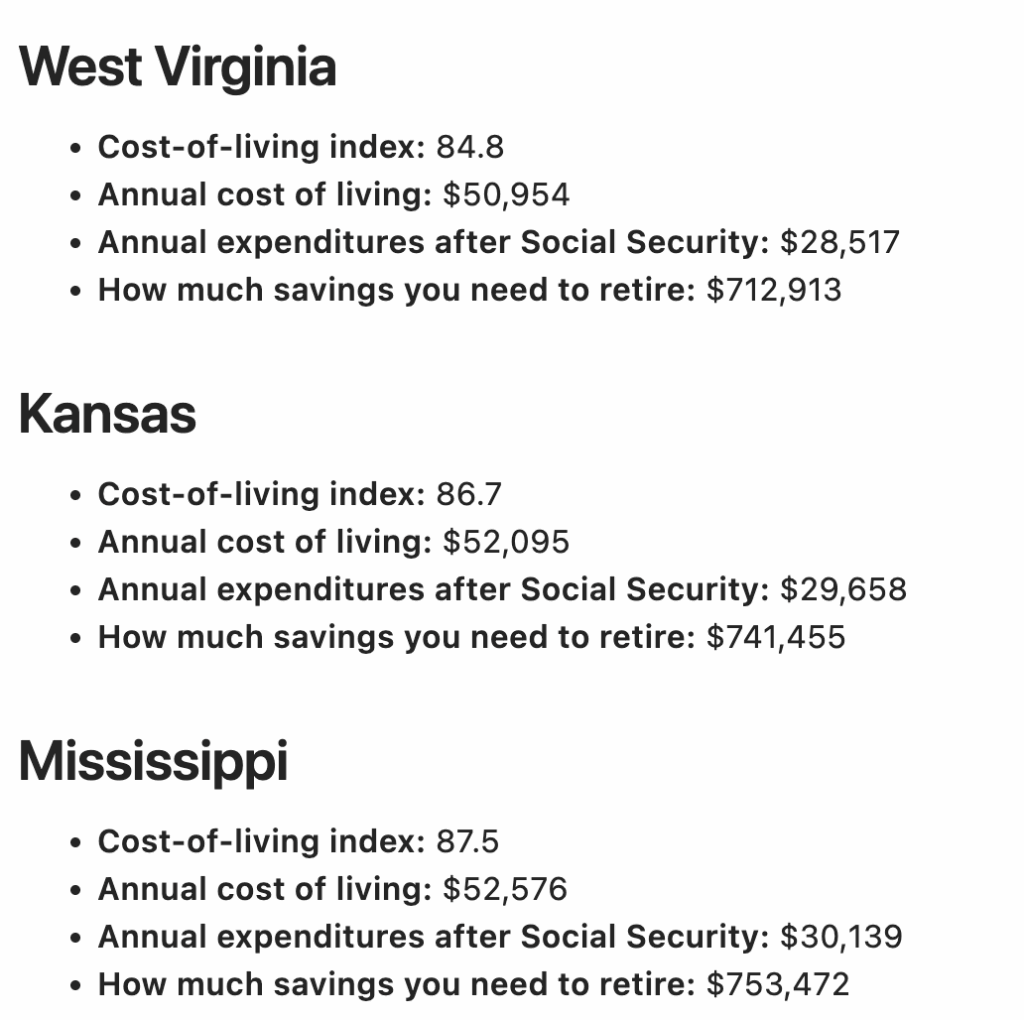

A recent study from GOBankingRates looked at the annual cost of living and annual expenditures after Social Security to come up with how much savings you need to retire in all 50 states. Some of the states on the list where savings go the furthest were surprising.

Top 10 States Where Your Retirement Savings Go the Furthest

- West Virginia

- Kansas

- Mississippi

- Oklahoma

- Alabama

- Missouri

- Arkansas

- Tennessee

- Iowa

- Indiana

West Virginia came out on top, where because of its low annual cost of living ($50,954), retirement savings of just $712,913 were enough for people to get by if their Social Security income was at least $22,000. By the time you get to Georgia, the difference was still not that great. Because the annual cost of living In the Peach State is $54.980, you would need savings of $813,559 to accomplish the same standard of living, assunming the same Social Security benefit.

“In Hawaii, the most expensive state in the Union, you would need retirement savings of $2,212,084 to match the standard of living you could get in West Virginia with $712,913 saved.”

From GoBankingRates.com Study

Over in the states where you need much higher retirement savings to get by, the differences are more stark. In Hawaii, the most expensive state in the Union, you would need savings of $2,212,084 to get by, given the annual cost of living is over $110,000. That is over 3 times the savings level required in West Virginia, a stark difference.

Strategies to Draw Down Your Retirement Savings in a Crazy Market

Related to how much you need to save to get by in different states, is how you should take the money out of your savings (which accounts, when, etc.) For example, money you take out of IRAs and 401(k)s is taxable – distributions from Roths are not. What type of assets you should draw down, particularly in uncertain markets, is another biggie. This free article from the New York TImes is very helpful on this topic

For further reading:

Topretirements State Mini-Guides (50 states plus 30 foreign countries)

Newsweek: Cheapest and Most Expensive States for Retirement

Comments: Have you considered retiring to a less expensive state than where you live now?

Do you like articles like this?

This is a reader supported publication. Please consider becoming a subscriber and help keep these articles coming.

Comments on "Looking for a State Where Your Savings Go the Furthest?"

Andy says:

Good article…Question- is the savings amount needed for one person or a couple? Two can’t always live as cheaply as one.

George says:

The list of the Top 10 States Where Your Retirement Savings Go Further does not match the list provided in the GoBankingRates article. In fact, Illinois is the 26th most expensive state. Kentucky is 17th and Georgia is 11th. The editors should correct the list.

With that said, the referenced article (and those like it) should only be used as general guidance.

Admin says:

Good catch George. Somewhere somehow we mixed up the list and put some states on there that didn't belong. Now corrected. Thanks for your sharp eyes.

Andy says:

Comparing States is a good way to get a general idea of costs, but comparing Cities within States and Cities between States is the only way to come to a conclusion before making any life changing decisions. There are some good calculators online to compare metro areas.

Shumidog says:

In WV a lot will depend on what part you live in. When I lived in Mercersburg, PA, my friends in Martinsburg saw their COL go up as families from the DC area looked for affordable housing. Also, the Berkeley Springs area, where the hot springs are, is quaint but expensive.

Admin says:

This comment came in from Marilyn to another post, but we are reposting it here because it is so relevant. Well said Marilyn!

---

How much money you need in retirement is too often the subject of articles for seniors. I don't see how someone can say you need $738,000 in savings, for example, to have a comfortable retirement. The analysis of how much one needs is far too personal and complex for such a statement. Is your home paid for or do you still have a mortgage? Is your car paid for? How is your health? How comprehensive are your home, car and health insurance policies? How much do you travel? Is your home new or older (money for repairs, maintenance), etc.,etc., etc.!!

Admin comment: Always great to hear from you, and thanks for your excellent insights. I couldn't express your thought better myself - how much money you need for a comfortable retirement is a very personal question. The only consistency is that you do need a certain level - you can't achieve that retirement without getting that level of money. And that means starting to save early and constructing a realistic budget.

Larry says:

When I see a ranking list like this, I recall the story of two friends dining in a restaurant, and the one says, "Isn't this food horrible?" And the other responds, "Yeah, but it is the cheapest restaurant in the area." If you have any health issue, or expect you might someday, you'd be nuts to consider any of the states at the top of the cheap-living list. According to the Commonwealth Fund, every one of the top five states is toxic when it comes to healthcare. Commonwealth's 2025 Scorecard on State Health System Performance ranks Mississippi dead last, actually 51st because the District of Columbia is also graded. The most affordable state, West Virginia, is ranked fifth to last. Oklahoma, the fourth most affordable state is also the third most dangerous to your health. Texas, renowned for its zero state income tax, holds down the second worst position for healthcare (and, perhaps, disaster preparedness). Rounding out the top 5 cheapo states, Alabama is ranked 42nd for healthcare and Kansas 33rd. Arkansas, by the way, makes the top five cellar-dweller list for healthcare at position #4. Sharp TR readers might have deduced a common trait among these unhealthy states, besides how much you'd save living there. (Not going to make the obvious political statement here.) But what is truly surprising is that the performance of virtually every Sunbelt state is in the bottom half of the Healthcare Scorecard. I can report that virtually all are located in the Sunbelt, a magnet for retirees because of the weather climate. But the climate for healthcare is a different story.

Admin Comment: An interesting perspective that people should consider in their retirement choices. Thanks Larry!

Mike says:

Looks like the average person is not going to have enough saved no matter what state they live in:

https://finance.alot.com/personal-finance/retirement-savings-by-state--20617