2019 Medicare Premiums Announced

Category: Financial and taxes in retirement

October 22, 2018 — Medicare costs for 2019 have been announced, and fortunately, the increases are small. The standard Part B premium amount is $135.50 (or higher depending on your income), vs. $134 in 2018. Part B deductible and coinsurance will be $185 per year, vs. $183. The Part A deductible for each benefit period will be $1,364 vs. $1,340 in 2018. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment (dme)

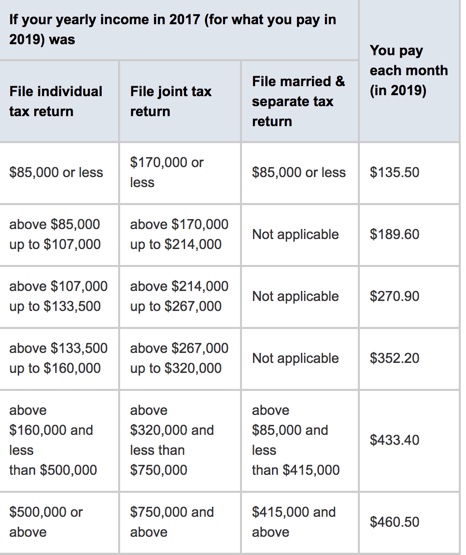

Certain people pay different Part B premium

The standard Part B premium amount in 2019 will be $135.50. Most people will pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

For further reading

For more about Medicare costs for 2019

Comments on "2019 Medicare Premiums Announced"

Admin says:

Judy asked: Is the Medicare Part B deductible, which I think will be 185.00 in 2019, in effect every year or a one time deductible?

Louise responded (thanks Louise!): Judy, the Part B deductible is per year.

https://www.medicare2019.com/medicare-deductible-2019/

Ron F says:

The part B Deductible is not 134 in 2018. It is 183.00.

Editors note: Thanks Ron, we have corrected that and appreciate you bringing it to our attention!