Medicare Continued: What You Need to Know About Medigap Insurance

Category: Health and Wellness Issues

November , 2017 — This installment on Medigap (supplemental) insurance is the latest in our 5 Part Medicare series, which has important implications for everyone as they reach age 65. Don’t miss Part 1: So You’re Turning 65: Here Is Your Guide to Medicare 101, and Part 2: Which Is Better, Original Medicare or Medicare Advantage (Links to Parts 3 and 4 at end of article).

In this article we will first explain what Medigap insurance is, and then how to find, compare, and buy a plan. Then we will reprint many of the Medigap comments that Members have posted to our other Medicare articles. We think you will find their collective wisdom useful.

Medicare Basics As a refresher, original Medicare includes Part A (hospital coverage) and Part B (doctor services). Almost everyone eligible for Medicare gets Part A at no cost, but there is a premium for Part B ($134/month for most people, higher income taxpayers pay more). Part C, the Medicare Advantage program, provides a PPO type alternative to Part B. Part C is offered by a list of government approved companies. Medigap policies can help pay some of the health care costs that Original Medicare doesn’t cover.

What is Medigap (Medicare Supplemental) Insurance

Medigap is supplemental insurance to Medicare (insurance to protect shareholders). Original Medicare pays the Medicare-approved amount for covered health care costs. But if you also buy a Medigap policy, that policy pays part or all of what isn’t covered, like copayments, coinsurance, and deductibles. These policies are available from private insurers. Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S.

A Medigap policy is different from a Medicare Advantage Plan. Those plans offer a different way to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

9 things to know about Medigap policies

1. You must have Medicare Part A and Part B to get one.

2. If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

3. You pay the private insurance company a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare.

4. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you’ll each have to buy separate policies.

5. You can buy a Medigap policy from any insurance company that’s licensed in your state to sell one.

6. Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium.

7. Medigap policies sold after January 1, 2006 aren’t allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

8. It’s illegal for anyone to sell you a Medigap policy if you have a Medicare Medical Savings Account (MSA) Plan.

9. Medigap policies generally don’t cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

How Can You Find a Medigap Policy

The process can be relatively easy. If you go to Medicare’s “Find a Medigap Policy” the page asks for your zip code to begin the process. From there you will see a variety of standardized plans you can choose from A to N (note this can be very confusing, because basic Medicare also contains Part A, B, C, and D. As Louise points out, it would have been less confusing if they had identified the Medigap plans differently!) Each plan type offers different benefits, coverages, deductibles etc., but every company offering one of those plans has to follow the standardized offering. The only differences are the costa and the reputation/service provided by the company.

That being said, many experts and members at Topretirements believe that you should use an agent help you select the right plan and guide you through the process. You will see more comments about that later.

Comparing Medigap Plans

Every Medigap policy must follow federal and state laws designed to protect you, and must be clearly identified as “Medicare Supplement Insurance.” Medigap policies are standardized: companies offering a plan (e.g;, A) must provide the same benefits. Medigap policies are standardized in a different way in Massachusetts, Minnesota, and Wisconsin.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

– Don’t have to offer every Medigap plan

– Must offer Medigap Plan A if they offer any Medigap policy

– Must also offer Plan C or Plan F if they offer any plan

Comparing Medigap plans side-by-side

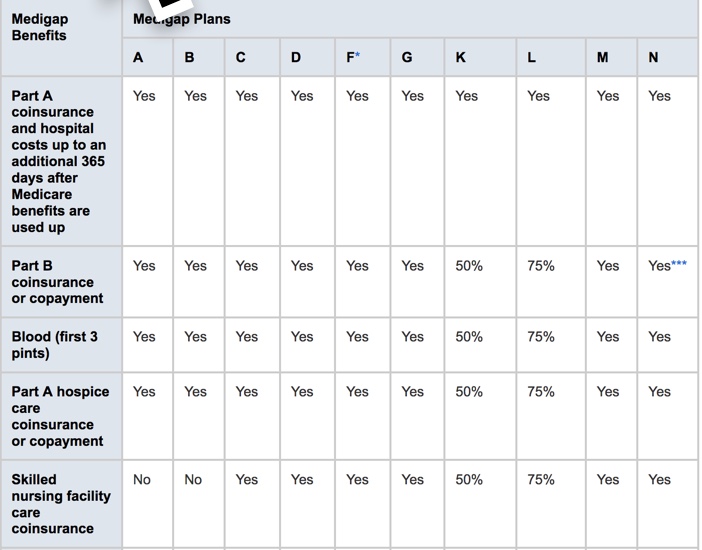

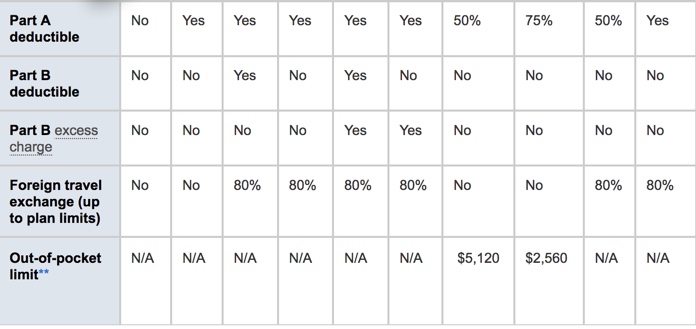

The hard part about Medigap insurance is comparing the different plans and making sure you buy the right one. The chart below shows basic information about the different benefits Medigap policies cover.

Yes = the plan covers 100% of this benefit

No = the policy doesn’t cover that benefit

% = the plan covers that percentage of this benefit

N/A = not applicable

Filling out your application

The Medicare.gov site has some great tips on how to fill out your application, pay for it, and make sure that you get the policy you want. We won’t go over those details here, but we encourage you to check out how to fill out and buy a Medigap policy.

Comments from Topretirements Members about Medicare

As we mentioned before our previous articles about Medicare generated a lot of comments pertaining to Medigap insurance. We have tried to sort those comments into categories.

It it worth buying a Medigap Policy

Note from Editor: This is a personal question and one worth considering for your particular situation. Since Medicare generally pays 80%, you are in effect buying insurance to pay for the “gap” that it doesn’t pay, including co-pays and deductibles. Some people might have the resources to self fund this insurance, but most enjoy the peace of mind that comes with this extra insurance. Understanding these ins and outs is why many people recommend getting a qualified insurance rep to help. Thanks to everyone who made these comments, you folks are a font of wisdom on this topic!

—

Medicare does not cover 100% of the cost for many things. This is where Supplement Plans come in. They pick up the difference. And you can go to ANY doctor or hospital (Anywhere). They cost more than Advantage and you do not have Drug coverage (Part D) unless you buy one separately. by Ron F

Plan F vs. Plan G

It should be noted that Original Medicare pays 80% and it is up to you to pay the 20%. Not all Medigap plans are created equal. Not all Medigap plans are offered in every State. Medicap prices vary from State to State. Also, consider, Plan F which pays all deductibles for hospital and doctors and pays the 20%. This leaves you, in most cases, with no bills, but it is one of the most expensive Medigap plans. There is also, in some States, a high deductible Plan F. Also, be aware, Plan F will no longer be offered after 2020 but those who have it will be grandfathered and can keep it.

–

Another thing people may not be aware of is that Medicare Part A (Hospital) has a benefit period of 60 days and a deductible that applies to each benefit period (rather than a calendar year deductible like Part B). As of 2017 the deductible was $1316 (per benefit period of 60 days). So if by some terrible chance you were admitted to the hospital 6 times (6 benefit periods) your deductible could be $1316 X 6 =$7896. That would be pretty unlikely but you never know. My Hub has Plan F and has undergone radiation treatments. The bills so far have exceeded $156,000. Medicare approved costs were something like $146,000 and we would have had to pay around $8,000. However, we have Plan F and have not received one bill so far. What a relief that is. Examine all the Medigap plans for what they offer. Each is very different in what they pay and what they cost. I turn 65 in August 2018 and am jumping on Medigap Plan F. Depending on what state you live in prices vary. Hub’s is $241.50 per month in CT. by louise

—

When I first started getting Medicare, I signed up for an Advantage plan – happy with the $0 premium but not so happy with the co-pays. While they weren’t awful, I was afraid of what they could become if I had a serious illness. While searching for the best premium (it definitely pays to shop), Mutual of Omaha suggested Plan G. The coverage is identical to Plan F but you pay the Medicare deductible, currently $183. This brought down my premium significantly – currently $129.62. I was able to cover the deductible in 4 to 5 months compared to the premium for Plan F.

Get a quote for Plan G, divide the difference in premium between Plans F and G, then compare the difference to the Medicare deductible. I’m sure you will see you will save money with Plan G. The potential downside is if the Medicare deductible goes up significantly, however, I suspect the Plan F premium will also go up to cover that increase.

Advantage plans, like conventional plans, vary and can change from year to year. I didn’t like paying a portion of every doctor visit or test. I felt a serious illness could possibly bankrupt me. You’ll also need to allow for premium increases. My increases have about been around $10 a month for the last two years. It doesn’t sound like much, but it will add up over the years. by Louise H

—

Louise,Just a point of clarification. When you turn 65 and are enrolled in Part B – ALL supplement plans including Plan G are guaranteed issue for the first 6 months. After that you have to answer medical questions. by Ron F

—

Only Plan C & F will be eliminated to new enrollees who join Medicare Part A on or after January 1, 2020. Those who have Plan F may want to consider Plan G. They are exactly the same except for one item. Plan G does not pay for the Part B deductible of $183.00. But the difference in cost is that the premium for Plan G is much less that 183.00. In my case Plan G cost me 138.00 a month and Plan F would cost 171.00 a month. That is 33.00 a month less or 396.00 a year savings that I can use to pay the 183.00 deductible and still have a profit of 213.00 in my pocket. Why would anyone have a plan G? Please compare where you live and stop overpaying for this stuff when you can have your cake and eat it too.?by Ron F — October 19, 2017

—

For what it’s worth, I went with a high deductible Plan F for $50/month (BC/BS, $108/month cheaper than their Plan F for my age). A $2200 deductible, but I’m in good health today and don’t need to pay for coverage I’ll likely not need, yet if I do, well, I can deal with it then. In the meantime, that’s about $1300 in premium savings that I can use to pay deductibles. I know BC/BS isn’t the cheapest, but I have plenty of experience with them with parents and relatives and they always pay, no argument. I also took the BC/BS Basic PDP drug plan for $25/month, same reasoning as the Hi-D Plan F, as much to avoid the monthly 1% monthly premium penalty going forward as for the actual coverage. by Peder

—Sign up for Medigap when you are first eligible

Because of pre-existing conditions we have been turned down by Medigap plans to supplement Medicare A/B. Therefore we are “stuck” with Medicare Advantage Plans. Mind you, that isn’t a bad thing. We have been very happy with “most” of the Medicare Advantage Plans. Where we live now there is only one Medicare Advantage Plan, which so far meets our needs. Fair warning here: sign up with Medigap plans when you first are Medicare eligible. After the fact your chances of being qualified for Medigap plans approach zero. by CB

Should you have an insurance agent help you

It is a good idea to speak with someone trained, licensed, and annually certified to help explain Medicare. It doesn’t cost anything to get accurate information. Unfortunately, I see many people taking (what they see) online as fact, when in reality there is a good bit of misinformation and misconceptions online including some alluded to here. To clarify a few:

-There is not an annual open enrollment for Medigap/Medicare Supplement plans. The open enrollment is 6 months and starts when you turn 65 or start Medicare Part B.

-The open enrollment rules for Plan F and G are identical – 6 months from first day of the month you turn 65 or start of Medicare Part B. After that – for either plan – you have to answer medical questions and be “approved” (with a few state-specific examples that don’t ask medical questions). This also pertains to Advantage plans. If you choose an Advantage plan when first turning 65, you have to answer medical questions to be eligible to switch to Medigap later.

-Existing Plan F policyholders are “grandfathered in” after 1/1/2020. Medigap policies are “guaranteed renewable” and can never be cancelled (unless you don’t pay the premium).

-Just generally, it is very difficult to make any general statements about Medigap or Advantage being better as it is very state-specific. Some counties have 1-2 Advantage plan options (no competition), and Medigap premiums vary from $60-70/mo in some states to $250/mo in other states (for exact same coverage). You have to look at it through the lens of where you live and what is available to you specifically.

-The Medigap plans are completely standardized – coverage, claims payments, doctor acceptance etc. However, even within the same area, prices can vary by as much as $100+/mo for same coverage. Companies charge whatever they can get approved by the state DOI. In many areas, the “big name” companies are much higher in price for the exact same coverage/service. by Garrett Ball

—

I’d like to emphasize that you should find a trusted insurance BROKER who specializes in Senior coverage, i.e. Medicare Medigap/Medicare Supplement, and Medicare Advantage plans. This is the person who has factual, up-to-date information for your state and situation. Reading online is helpful to get some baseline and background information, but make a decision with the help of an expert. It’s too important to risk making the wrong decision. by Jean

—

I took F with Mutual of Omaha originally in GA after I retired in 7/16. Switched to G in November with no issues at the time we enrolled my wife and took G. The MOH rep was most helpful in this decision and in what to do going forward. We bought a home in AL in December, moved in June and updated our registered information with all insurers, including MOH. Smooth process albeit there were some rate changes applicable to AL as each insurer reviewed the new address with us. D went up a smidge as I recall and G went down a bit for both of us….in short, by talking with MOH as we were looking at retirement options, we were provided with the then G rates in place at each and what to do when actually moved. by JeffH

—

Bottom Line

Whew, this is one of the longest articles we have written here. It is a lot to digest; our only hope is that it is helpful in getting you started down the road to some smart Medicare decisions. If you have comments or questions, please add them in the Comments section below.

More Resources to Help

Part 1: So You’re Turning 65: Here Is Your Medicare 101 Course

Part 2: “Topretirements Members to Washington: We Like Medicare, Please Keep It That Way”

Part 3: What to Do about Medical Insurance When You Retire Early

Ultimate Guide to Medicare

Part 4: Medicare Advantage vs. Original Medicare

Part 5: What Is Medigap Insurance and How Can I Find the Right Policy for MeWhat Is Medigap

When Can I Buy/Tips on Buying Medigap Insurance

Comparing Medigap Plans

Medigap Questions

Consumer Reports: The Best Medigap Plan for You

Comments? Please share your thoughts in the Comments section below.

Comments on "Medicare Continued: What You Need to Know About Medigap Insurance"

Louise says:

This is a good article. However, when I first started investigating all of this I found it super confusing! What was really confusing to me it that there is Medicare Part A, Part B, Medicare Advantage Part C, and Prescriptions Drugs Part D. Then you have the Medigap plans A, B, C, D, F, G, K, L, M, N. Wish they could identify these plans so the Medigap plans had a significant different name so they weren't so close to each other. Something like Medi-A, Medi-B...Maybe it is just me being a blockhead! I also thought when you got your Medicare card it was just Medicare, a health program. Didn't realize there was Part A and Part B and Part B is not mandatory but if taken costs $134 a month. Plus, Part D, not mandatory (various prices). I understand it all now, but whew, it takes some time!

Debra says:

Every state has a very helpful navigator to steer you through this process. An agent however stands to make money.

Peter says:

I signed up for a Medigap policy, Plan G, with the premium savings per month more than covered the deductible than with Plan F. I bought a Medigap policy premium and insurance company rating comparison for my address from "Weiss Research" which I paid $49.00 for and it covered every insurance issuer that offered Medigap plans for my address. It was very well done and makes choosing the lowest cost plan/premium easy. The plan G policy I selected was a top rated insurance company and the premiums were substantially lower than the next lowest premium, which was from a top tier rated insurance company also. The U.S. government's website also provides good information too, but isn't as extensive as to what the Weiss Medigap Report provided. The Weiss Report can be found on the internet, just "Google" it.

Ralph says:

Do I need medical if I have TriCare for Life?

Linda says:

My mother had TriCare for Life and some sort of supplement plan from AARP which they no longer sell. She never paid anything for any of her medical adventures, of which there were many. When she would gripe about a $3 co pay for prescriptions, I would remind her how good she had it compared to the rest of us.

So take a look at what the supplement would cost, what TriCare doesn't cover, and decide if it would be worth it to you.

Jennifer says:

I live in Washington, DC and most Internal Medicine practices here do not participate with Tri-care, nor did the surgery practice that I worked with for 12.5 years. Too many hoops to jump through.

Lynn says:

Most Florida practices accept Tricare. My parents paid very little, other than their Part B premiums, for Tricare for Life. However, Congress plans to increase the copays and fees that new and existing recipients pay. Sad to say that the increases may be quite steep. It is well worth getting on the various mailing lists and supporting the various military and retiree advocacy organizations ifor those of us covered by Tricare. We all could experience some steep increases in what we need to pay.

Admin says:

We are moving a group of comments about medical insurance from an unrelated topic here for a better fit:

Michael, I have to buy my own health insurance. Consider Christian Health share Ministries in Barberton, Ohio, It is a company that was founded in 1981 and has nearly 400,000 members. Their gold plan is $150.00 per month plus for $40.00 per year and $25.00 a quarter you can also get catastrophic coverage. It is NOT traditional insurance, but if you fall ill and it is not a pre-existing condition you submit your bills (over $500.00) to CHM and they share the bill among the members. You will receive cards and prayers from the members and feel the caring of the other members. Once I go on Medicare next year, I will use it as my secondary coverage. You will ask your providers for a cash discount CHM can also do this for you before they pay the bill. Many traditional insurance plans have high deductibles–much more than $500.00 and monthly fees that are unaffordable. There are other companies like Liberty Health share and Medi-share that you might want to check into as well. Many companies have changed to the health share model due to the high costs of traditional insurance. This has worked for me so far. CHM was endorsed by Dave Ramsey and my first $150.00 was paid because I mentioned that I heard about them from him. Also for Dental–check into 1Dental.com for $99.00 per year and they also cover vision as well. These are just suggestions…we do not have to be gouged by huge insurance premiums just because we are not yet 65.

Michael, I have to buy my own health insurance. Consider Christian Health share Ministries in Barberton, Ohio, It is a company that was founded in 1981 and has nearly 400,000 members. Their gold plan is $150.00 per month plus for $40.00 per year and $25.00 a quarter you can also get catastrophic coverage. It is NOT traditional insurance, but if you fall ill and it is not a pre-existing condition you submit your bills (over $500.00) to CHM and they share the bill among the members. You will receive cards and prayers from the members and feel the caring of the other members. Once I go on Medicare next year, I will use it as my secondary coverage. You will ask your providers for a cash discount CHM can also do this for you before they pay the bill. Many traditional insurance plans have high deductibles–much more than $500.00 and monthly fees that are unaffordable. There are other companies like Liberty Health share and Medi-share that you might want to check into as well. Many companies have changed to the health share model due to the high costs of traditional insurance. This has worked for me so far. CHM was endorsed by Dave Ramsey and my first $150.00 was paid because I mentioned that I heard about them from him. Also for Dental–check into Dental1.com for $99.00 per year and they also cover vision as well. These are just suggestions…we do not have to be gouged by huge insurance premiums just because we are not yet 65.

It is 1dental.com—sorry I transposed it by mistake. It is a $99.00 per year Dental/vision plan also endorsed by Dave Ramsey and they have a network of dentists who participate for pre negotiated prices. I called them and they checked my area in DC and there were 17 Dentists in my direct vicinity–two within walking distance. Before making an appointment, I would check on YELP for the ratings the dentist gets, just because a provider is in a program does not mean they are good. I vet them thoroughly.

Good Luck. Jennifer

---

I belong to Dentalplans.com. It has worked out good for us since 2015. After the negotiated price is figured, it costs us $101 for a cleaning/check up. We are in CT so prices are probably higher here. Louise

---

Michael Alwardt, My hub retired at age 63 and after that we went on Obamacare. We have kept our income below the 400% poverty level ($64,960) to get the subsidy to help pay for the insurance. For the two of us with subsidy we paid $495 a month. Hub went to Medicare last year and I stayed on Obamacare. Because they base the cost on family income the cost remained around the same for me, one person. Not sure what State you are in but CT is one of the highest cost state to live in too and that is where we live.

Not sure what the future of Obamacare is now that it seems to be on the chopping block but for now it is still hanging in there. I go to Medicare in August. Good luck on your decision to retire! Louise

---

Admin says:

Sandyg sent in this question:

Hope someone can tell me - I'm still working and carry the health ins. for my husband who is retired and my self. I hope to retire in Jan.2019 at which time we will go on medicare -hope to take medigap plan G here in NY ,but plan to move to AZ after we sell our home . If that all takes longer than the 6 month free grace period where you don't have to answer any health questions - are you able to continue with medigap G without answering health questions in AZ if we have to change ins. co. due to NY doesn't offer same ins. co as AZ? Thank you

Sandyg