What Is Your Financial and Retirement Literacy IQ?

Category: Financial and taxes in retirement

June 17, 2025 — Many Americans are stumped when it comes to understanding important financial and retirement issues. Asked questions related to Social Security benefits, Medicare coverage, employment-based retirement savings, most respondents in a recent study bombed. On average, they only answered two of the six questions on these issues correctly.

We’re including the quiz below so you can see how you would do!

The bad news comes in a new report from the TIAA Institute and the Global Financial Literacy Excellence Center at the George Washington University School of Business. There were six questions in the 2025 survey used to gauge basic retirement fluency. Those included knowledge promoting financial well-being in retirement. Each question covered a distinct subject: Social Security benefits, Medicare coverage of healthcare expenses, employment-based retirement savings, ensuring lifetime income, likelihood of needing long-term care at older ages, and life expectancy in retirement.

2025 PERSONAL FINANCE INDEX

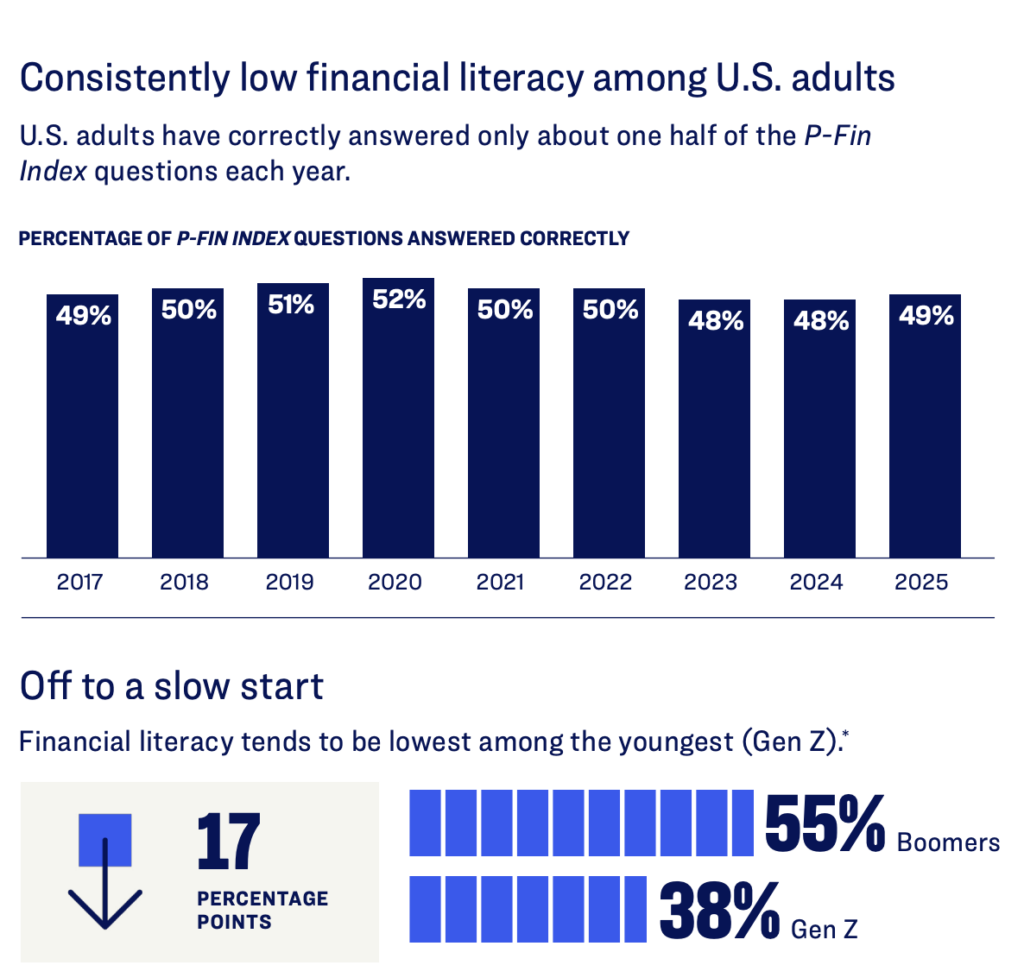

The 2025 results for all financial and retirement questions are in line with results from previous years. On average, U.S. adults correctly answered only 49% of the 28 index questions in 2025, which was slightly less than the 52% in 2020. Only 16% of people in the study answered at least 75% of the questions correctly. Obviously, financial and retirement literacy is important. Understandably, well off individuals generally scored higher than lower income levels. Men tended to have better scores than women, and whites and Asians did better than Blacks and Hispanics. Knowledge of these issues among members of the Gen Z and Gen Y was much lower than those in the Gen X, Boomers, and the Silent Generations.

Take the Retirement Literacy Quiz!

Which statement about Social Security is false?

- The amount someone receives in Social Security benefits depends upon his/her earnings during the

last two years of full-time employment. - A worker receives Social Security benefit payments if he/she becomes disabled before retiring.

- Social Security benefit payments will continue as long as an individual is alive, no matter how long he/she

lives. - Don’t know.

On average, Medicare and other government programs cover how much of an individual’s health care expenses in retirement?

- Over 90%.

- About 2/3.

- About 1/2.

- Don’t know

Latisha plans to start saving for retirement by setting aside $2,000 this year. Her employer offers a 401(k) plan and fully matches a worker’s contributions up to $5,000 each year. Under which scenario does Latisha have the largest amount in retirement savings at year-end?

- She contributes $2,000 to the 401(k) plan and invests the money in a mutual fund that earns a 5%

return during the year. - She contributes $2,000 to an IRA (individual retirement account) and invests the money in a mutual fund

that earns a 5% return during the year. - It does not matter—she will have the same amount of year-end savings either way.

- Don’t know

Susan worries about living a long life and running out of money. What is the best way for her to address that possibility?

- Buy an annuity.

- Buy life insurance.

- There is nothing she can do about this.

- Don’t know

On average in the U.S., how long will a 65-year-old [man/woman] live?

- About 14 more years (age 79)/About 17 more years (age 82).

- About 19 more years (age 84)/About 22 more years (age 87).

- About 24 more

What is the likelihood that a 65-year-old will eventually need some type of long-term care services?

- About 30% (3 in 10).

- About 50% (5 in 10).

- About 70% (7 in 10).

- Don’t know.

On average in the U.S., how long will a 65-year-old [man/woman] live?

- About 14 more years (age 79)/About 17 more years (age 82)

- About 19 more years (age 84)/About 22 more years (age 87).

- About 24 more years (age 89)/About 27 more years (age 92).

- Don’t know.

Do you like articles like this?

This is a reader supported publication. Please consider becoming a subscriber and help keep these articles coming

Become a Subscriber!

How did you do?

Test Answers

Social Security false statement: Last 2 years

Medicare expenses: About 2/3rds

Latisha: Invest $2000 in the company’s matching 401(k) plan

Susan: Buy an annuity

Likely life expectancy at 65 for a woman: About 14 years

Likelihood of needing long term care: About 79%

Conclusion: It is really tough to have a secure and happy retirement if you don’t have a good understanding of retirement and financial issues. If your test results aren’t so great, it is time for you to invest some time boning up on these topics. Read the financial columns, take an online class, talk with an advisor, or consult with a friend who is savvy in this area. See the full report from the TIAA.

Comments on "What Is Your Financial and Retirement Literacy IQ?"

JCarol says:

For many, there is also a world difference between taking early SS benefits at age 62, rather than delaying them until full retirement age (now close to age 67) or when maximum benefits will be paid (age 70).