Biggest Worry About Retiring? Running Out of Money

Category: Financial and taxes in retirement

July 23, 2025 — Almost two thirds of Americans have this understandable fear- that they will live longer than their money lasts. According to the Morningstar Center for Retirement & Policy Studies, 45% of Americans who retire at 65 have an increased risk of running out of retirement savings before they die.

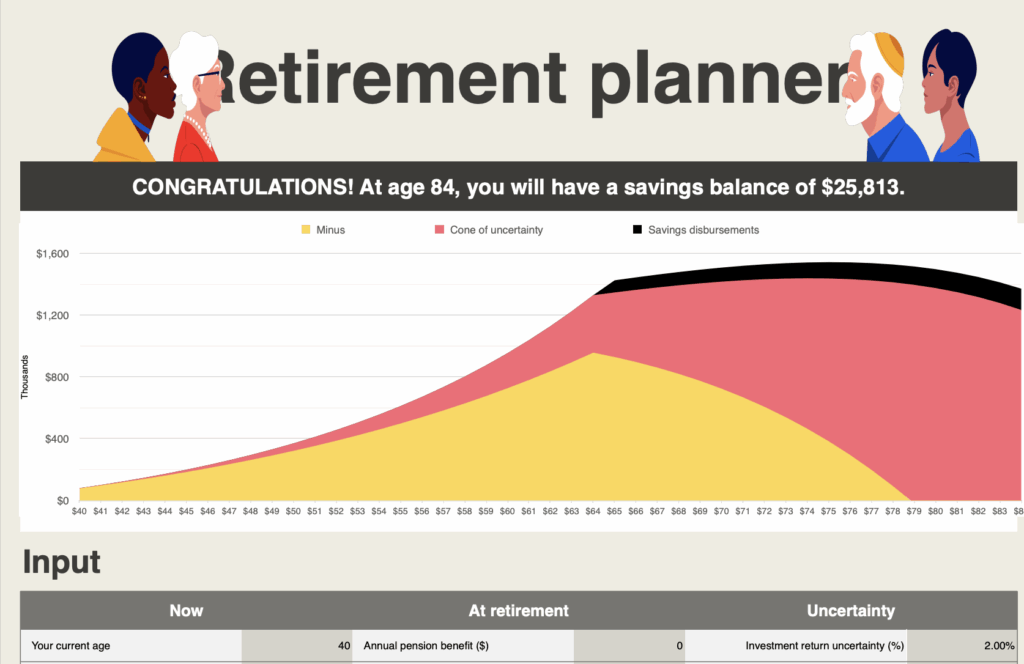

The basic problem is that most people haven’t saved enough for a comfortable retirement. Just over half of baby boomers have saved less than $250,000. Another problem, even for retirees who do have significant retirement savings, is that most do not have a systematic approach to withdrawing those funds. One study by IRALogix found that only 22% of retirees have some kind of plan for taking down their savings. This article will try to provide some help on that score.

The Money Stops Coming in

It can be a shock when those monthly paychecks don’t arrive anymore. Social Security can help, but there are very few places in the country where one can live comfortably just on that source. How much you get from SS is determined by how much you earned over your best 35 work years and at what age you start taking the benefit. The average combined Social Security benefit for a couple in 2025 is $3,814, and the maximum is $9,746 (that’s for a a couple where each person earned the maximum amount for 35 years and claimed at age 70).

Since Social Security is not going to be enough to maintain most people’s pre-retirement lifestyle, they are going to have to supplement that with withdrawals from their savings or part time work. Or, they will have to cut expenses by downsizing or reducing other items.

Do you like articles like this?

This is a reader supported publication. Please consider becoming a subscriber and help keep these articles coming

Become a Subscriber!

You Can Do It! – Start with a Strategy

The big problem most people have is a lack of strategy. They retire, and then they start withdrawing money. WIthout a plan, it’s all too easy to spend it down too quickly and run short at the end. Or, many folks scrimp, and miss out on a more rewarding lifestyle.

Start with knowing what your expenses are. There has to be a target that be budgeted to. Put together a realistic budget of your expenses and expected revenue sources as a first step, factoring in what you estimate your life expectancy to be. Paid subscribers can access our Budget worksheet below.

Realize that expenses will change over time. In the go go years when people first retire expenses will probably be higher than they will be later. Long planned vacations, moving expenses, entertainment, etc. can add up. In later years travel and entertainment expenses often go down. In a person’s later years they might spend less – or more – if expensive medical and assisted care is needed.

What is your end goal. Do you want to maximize your lifestyle and spend all your assets by the time you die? Or do you want to provide a legacy for your loved ones or a favorite charity? These decisions help decide your withdrawal rate.

The 4% rule. Long popular, many experts believe that if you withdraw your savings at about 4% per year the probability is you will never run out of money. That assumes you have a sound investment strategy.

Withdrawing early in good times. One strategy that experts suggest is when the markets are strong, withdraw money in advance. This avoids having to take it out later in a down market.

Schedule regular withdrawals. Your financial advisor or mutual fund company can help you set up a regular schedule for your budgeted withdrawals. This makes life easier since you know the money will be there when you need it, allows you to stick with your budget, and averages out ups and downs in the markets.

Annuities. These financial tools, which provide guaranteed payments over time, have their fans and detractors. What they do offer is the peace of mind from knowing you will be getting a set amount each money.

Hire a professional?

People with significant retirement assets often hire a professional investment advisor to help build their withdrawal schedule. This can be done either on a percentage of assets or fixed fee basis.

Comments? Do you have a retirement budget that tries to match your expenses and income? Do you have a systematic plan for withdrawals, or do you take money out as you need it. Finally, do you think you will outlive your money? Please share your thoughts in the Comments section below.

Comments on "Biggest Worry About Retiring? Running Out of Money"

JCarol says:

I'm concerned about do-nothing government "leaders" who refuse to proactively address the likely haircut to about 83% of current benefits SS come 2033, and bigger cuts as time goes on. Ditto on Medicare's Hospital benefit fund that's on track to insolvency a couple of years later (estimates are it will only be able to pay 89% of costs circa 2036).

When I look at our retirement funds vs. needs, it's always with an eye to what will happen when/if one of us predeceases the other, thus losing the smaller of our SS benefits. So far, the numbers are playing out ok, but it be more challenging if benefits are cut to 80%-ish.

Now 73, I'm glad we're still be earning some income through our consulting business rather than being fully retired.