So I Asked AI – When Can I Retire?

Category: Financial and taxes in retirement

July 29, 2025 — Everybody’s talking about Artificial Intelligence (AI). Governments are fretting about how to control it, employees worry it will take away their jobs, and a lot of other folks don’t really care. The reality is that it is going to get even more important, and about to change our world profoundly. On the plus side, your imagination is the only limit to the many ways you can use it to help with your daily life.. Here’s one very specific use – how to predict when you can retire, and how much it will take to do that comfortably.

Start by logging into a free AI service

We’ve been using ChatGBT (OpenAI), but there are plenty of others to choose from. Those include Google’s Gemini for creative tasks and Anthropic’s Claude. Microsoft’s Copilot is another good one. You will probably have to create a login. They are usually free to start with, but if you use them a lot you will have to pay a relatively modest fee.

So When can I retire?

So I asked ChatGBT: “When can I retire?”

Here’s what they came back with — in seconds:

Key Questions to Determine Retirement Timing:

- How old are you now?

- What is your desired retirement age?

- Have you worked at least 10 years in jobs that paid into Social Security?

- What are your estimated Social Security benefits?

- Do you have other retirement income sources? (e.g., pensions, 401(k), IRA, rental income, etc.)

- What are your monthly or annual living expenses?

- Do you plan to retire fully or work part-time in retirement?

- Do you have healthcare coverage lined up (especially before Medicare eligibility at 65)?

Pretty good start AI! These are the right questions.

What’s Next – Fill in the Blanks

To give a good example of how AI can work on a problem like this, I created a fictional retiree. Josie is 55, would like to retire at 65, had 35 years paying into SS (but doesn’t know potential benefits), has no pension, and has about $150,000 in retirement assets. Annual living expenses now are about $65,000/year against an income of $75,000. She expects expenses to decrease to $50,000 at age 65, when her mortgage is paid off. Might work part time in retirement if the right job came along. No health coverage until Medicare kicks in at age 65. Obviously you can fill in your own data, using different scenarios to see your options.

Here’s What Came Back from AI

When I first did this analysis I didn’t include her adding any retirement savings from age 55 to 65. The analysis showed her exhausting her savings by age 75. So I revised it: now she puts $10,000/year into retirement funds from age 55 to 65. Her money lasts a lot longer!

Can I Retire at 65? A Realistic Budget

If you’re 55 and wondering whether you can afford to retire at 65, here’s a realistic scenario based on steady saving and moderate expenses.

Profile Overview

- Current Age: 55

- Retirement Target: Age 65

- Years to Save: 10

- Current Retirement Savings: $150,000

- Annual Contributions: $10,000/year until retirement

- Recent Earnings: $75,000/year

- Social Security Record: 35+ years of contributions

Retirement Budget Plan (Starting at Age 65)

- Estimated Retirement Savings at 65: ~$395,000

- Social Security Income: ~$24,000/year (starting at age 65)

- Living Expenses in Retirement: $50,000/year (rising with inflation)

- Other Income: None planned after age 65

- Healthcare: Covered by Medicare

Cash Flow Analysis

At retirement, you’ll need to withdraw about $26,000/year from savings to cover the gap between Social Security and living expenses.

- Withdrawal Rate (First Year): ~6.6%

- Sustainability: Savings likely last until age 86–88

This projection assumes:

- 5% average annual investment return

- 3% inflation rate

- No part-time work or additional income

How to Strengthen the Plan

- Delay retirement to 67–70 to increase Social Security income

- Lower expenses to $45,000/year to reduce withdrawals

- Work part-time during early retirement years to preserve savings

- Continue saving aggressively over the next decade

Conclusion

With disciplined saving and moderate spending, retiring at 65 is possible and sustainable for at least 20+ years. Small adjustments—like delaying retirement by 1–2 years or trimming expenses—can provide even more security and peace of mind.

Wow, That’s Pretty Useful

Asking AI questions like these might be the most useful 5 minutes you ever had. While obviously not a complete picture, it’s a great snapshot. Substitute the actual numbers for your situation, like how much you save every month, facts about your home equity and mortgage, how much you would like to leave in your estate, estimated inflation and investment rates, etc., and you get a pretty good idea of what to expect. Improve the accuracy by going to SocialSecurity.gov and getting a detailed estimate of your future benefits at various retirement ages

So What Did Google’s AI Tool Say About Josie’s Retirement Plan

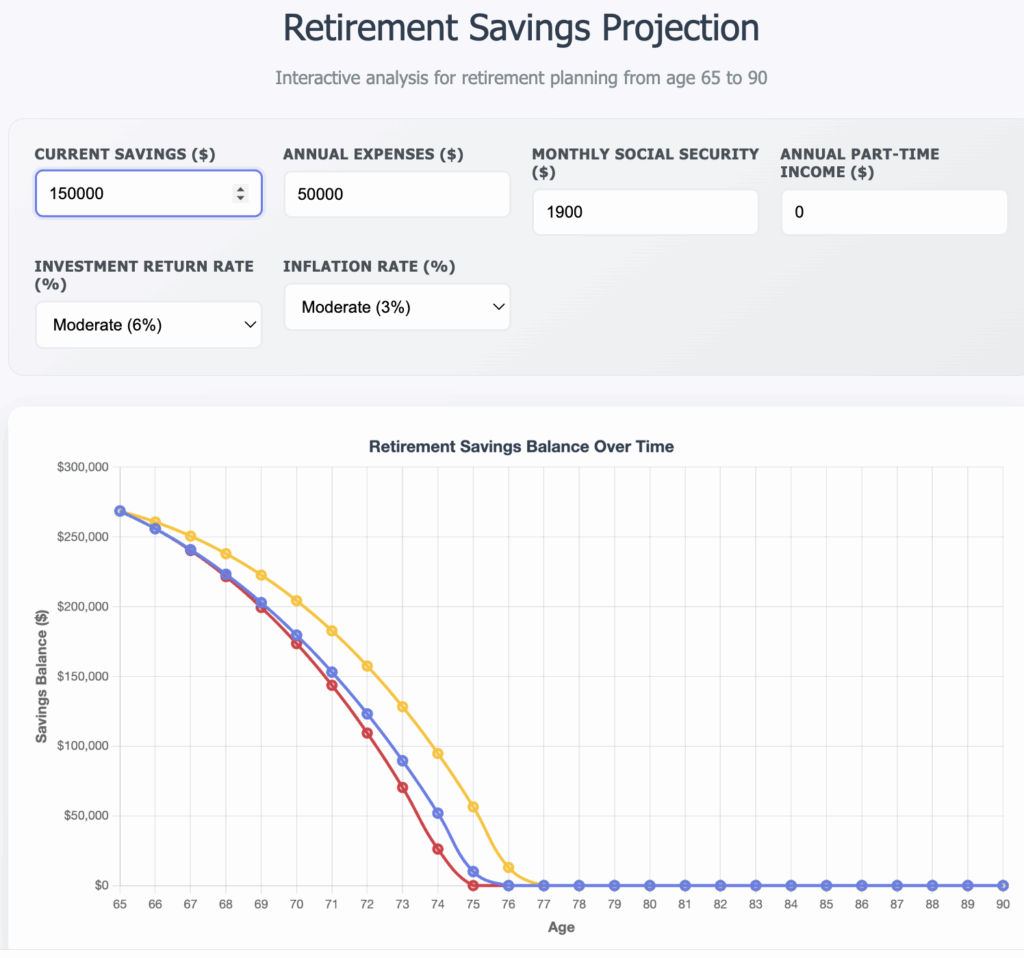

I wanted a second opinion, so I asked Google’s AI tool, Claude, to do the same projection, but with one key difference: The Claude assumptions do not include the additional $10,000/year in retirement contributions age 55 to 65. The results were similar to ChatGBT’s first crack at it. But one nice thing Claude did was to create an interactive tool that lets anyone plug in their own parameters. You can access that tool using the link below the chart.

You can see from the image below that Josie is in trouble without those extra savings from age 55-64. At her spending rate all of her retirement savings will be gone at age 75. So, unless she makes some big adjustments, she will be in trouble.

Click on this link to access an interactive version of this chart – plugin your own parameters.

AI Isn’t Always Accurate!

Go in with the assumption that AI sometimes makes stuff up. Just ask anyone who has a lot of experience with it. So it is always wise to get inputs from other sources too. That includes professional financial advisors, as well as the free retirement calculators available at mutual fund companies like FIdelity and Vanguard. Be wary that one source might use different assumptions in the calculations they make, with very different results. The more specific your requests, the more accurate the output.

What Else Could You Use AI for?

The possibilities are endless. From finding out great plans for entertaining your grandkids, to what to serve at a backyard party for a guest with dietary restrictions, AI is ready to help. Here’s one example. We had a mailing list that was in a Word document. What we wanted was to get all of the names, addresses, phone numbers, etc. into a spreadsheet so it could be manipulated and uploaded to a service. Doing that by hand was going to take days, and be incredibly tedious. So we asked AI to do it – completed in seconds!

Don’t forget Topretirements!

Besides using AI to help you figure out other things, like where to retire, we hope you will rely on the helpful reviews of the best places to retire at Topretirements – See our National Best Places Directory and Community Explorer tool to help with that.

Comments? What have you been using AI for? Do you have suggestions others could use! Please let us know in the Comments section below.

Do you like articles like this?

This is a reader supported publication. Please consider becoming a subscriber and help keep these articles coming

Comments on "So I Asked AI – When Can I Retire?"

Stevo says:

Is it just me or is anyone else a little leery about putting your personal financial information into a tool sponsored by Google? Just hire a financial advisor who can answer questions about how they came up with the results etc....

Larry Lan Sluder says:

Interesting, but you have at least one important fact entirely wrong. Claude AI was developed by Anthropic. Google's AI is called Gemini.

Admin says:

Thanks for the correction Larry. And Stevo, I understand your suspicion about AI. Scary stuff, they already seem to know everything about us!

Chris says:

I have been using Microsofts AI Image Generator with pretty good results. You can make up cartoons, birthday cards, illustrations for articles, or just have fun with it. Try it. https://create.microsoft.com/en-us/features/ai-image-generator

Daryl says:

So AI keeps everything you feed it, right? And of course links it all to you, but you don’t own it? Then it can use whatever you give it for its own purposes? And when they sell that data, your creations, to other data brokers, they now own your birthday cards, cartoons, financial data, literary musings. And the scenario builds from there. No thanks. Fed up with Big Brother.

Jan Cullinane, author says:

As I say in my best-selling retirement books, you can retire when you can answer "YES" to these three questions: Do I HAVE enough? Have I HAD enough? Do I HAVE enough to do?

Admin says:

Those are the perfect questions - in a nutshell! The second 2 should be pretty easy, with a little thought and planning. It’s the first one that can be the hardy one to figure out, and it’s a biggie. Thanks Jan

Tess says:

Having read Jan's book prior to my retirement, I really appreciated those questions. I answered yes then, and now, years later, I can still answer yes. It's good to know I made the right decision.