Retirement Real Estate: Which State is Best – Arizona, Florida, North Carolina, or Pennsylvania

Category: Best Retirement Towns and States

Oct. 21, 2025 — Choosing where to retire often comes down to quality of life and housing affordability and stability. Of course there are other factors like medical care that should go into choosing where to retire, but housing is usually one of the top considerations. So, if you are thinking about retiring in one of the popular retirement states of Arizona, Florida, North Carolina, or Pennsylvania, which has the best retirement real estate market?

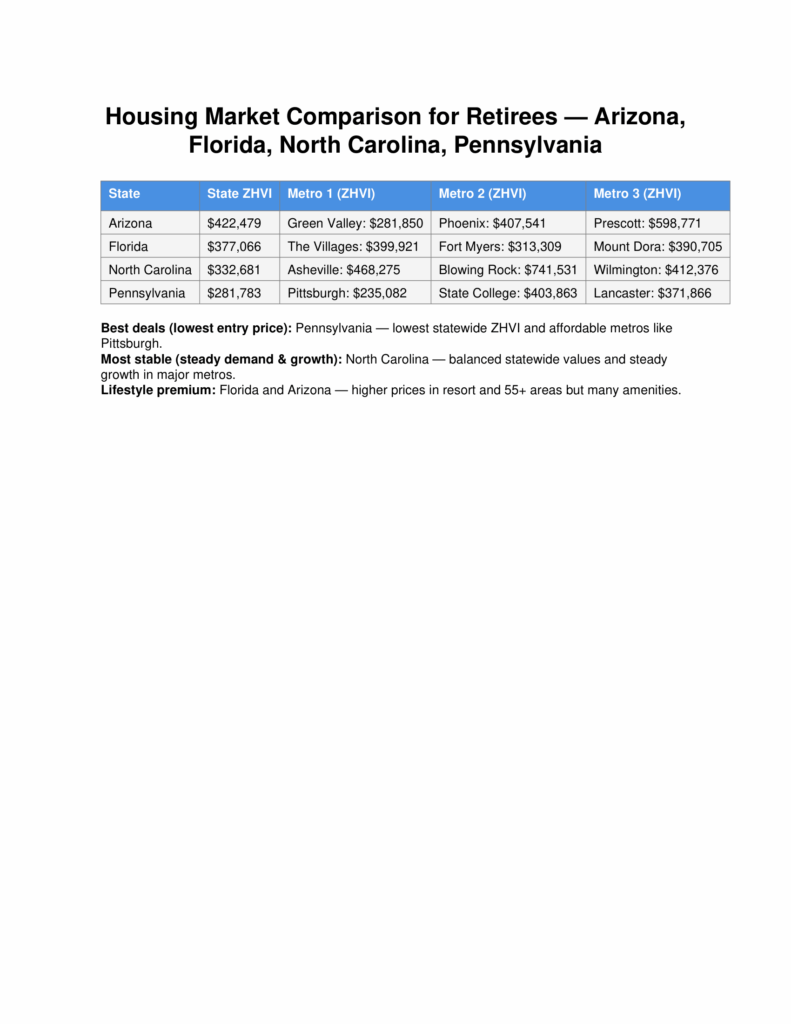

Below is a data-driven comparison of the real-estate market a typical retiree would care about. We have provided statewide price levels (Zillow Home Value Index / ZHVI) for 4 states that tend to attract the most retirees. Within each we chose three representative retirement metro markets. At the end we close with which state looks like it has the best “deals” today, and which looks most stable.

By comparison, the most recent U.S. Zillow Home Value Index was $363,963.

At a Glance ZHVI (typical home value) (Oct. 2025)

| State | State ZHVI | Metro 1 (ZHVI) | Metro 2 (ZHVI) | Metro 3 (ZHVI) |

|---|---|---|---|---|

| Arizona | $422,479 | Green Valley: $281,850 | Phoenix: $407,541 | Prescott: $598,771 |

| Florida | $377,066 | The Villages: $399,921 | Fort Myers: $313,309 | Mount Dora: $390,705 |

| North Carolina | $332,681 | Asheville: $468,275 | Blowing Rock: $741,531 | Wilmington: $412,376 |

| Pennsylvania | $281,783 | Pittsburgh: $235,082 | State College: $403,863 | Lancaster: $371,866 |

Data sources: Zillow ZHVI (state and metro pages), compiled Oct 2025.

What the numbers mean for someone considering retirement

1. Price level (who’s cheapest right now?)

Pennsylvania clearly shows the lowest statewide ZHVI at about $281.8k. The Pittsburgh area is a particularly good bargain, with much lower home prices than elsewhere in PA and other states. In Florida, real estate prices in some markets have flattened or fallen significantly in the past year due to insurance and climate concerns. Prices in the areas of the Sunshine State that we selected are near the national ZHVI of $363,963 (but can be much higher in cities like Miami). Home prices in North Carolina tend to be more expensive, and Arizona has the highest of the four at $422,479.

Find out prices in more markets! Zillow’s Home Value Index is an excellent tool for finding out home prices by state and town. You can enter up to 4 markets to compare.

2. Tradeoffs by market

Home prices vary tremendously from area to area. Whereas the Index is $741,531 in Blowing Rock, NC, just down the road in Hendersonville it is only $408,152. Florida and Arizona have high-value, coastal or resort pockets (e.g., Miami, Scottsdale) that remain expensive — but both states also have mid-price metros (Tampa, Phoenix) that can be reasonable depending on neighborhood. North Carolina sits between these extremes: statewide values are moderate, but high-demand metros (Raleigh, Asheville, Blowing Rock) are pricier. If your top priority is lower purchase price for a primary residence or a downsized retirement home, some parts of Pennsylvania currently offers the best deals on a pure price basis. But within any state, as seen in North Carolina, your housing dollars will go much farther in some parts of any state than others. In Florida this is particularly true as you move away from the coast.

3. Recent volatility & short-term direction

Through 2024–2025 many formerly hot markets cooled and showed year-over-year declines (Florida and parts of Arizona had notable declines), while some inland/secondary-city markets held up or even grew modestly. That said, the national housing stock and value picture has shifted a lot over the last five years, and smaller cities have been driving a chunk of recent gains. This means bargains can appear in non-coastal, mid-sized metros. The impact of lower interest rates on mortgages and a possible slowing economy is a big question.

Which state looks like the best deal — and which is the most stable?

Best deals: Pennsylvania

- On a pure median / ZHVI basis, Pennsylvania is the most affordable of these four states right now — it has statewide ZHVI and metro ZHVI numbers that are a fraction of Scottsdale or Miami. For retirees looking to stretch retirement savings, PA offers lower purchase prices and many smaller cities with lower cost of living.

Most stable: North Carolina — or Pennsylvania for fiscally conservative buyers

- “Stability” can mean steady, modest appreciation and less headline volatility. North Carolina’s statewide ZHVI shows only a small year-over-year change, while Charlotte/Raleigh’s tech and finance growth support steady demand support possible resale and long-term appreciation. Pennsylvania’s market, while affordable, can be more local-market dependent (older industrial metros vs. stronger suburban markets). If you want modest, steady markets with upside, NC looks strongest; if you want the lowest entry price and don’t need a big long-term price run-up, PA is safest on budget.

Practical retiree considerations beyond price

- Taxes & cost of living: Florida has no state income tax (appealing for Social Security and retirement income); States like Pennsylvania tend to be retirement income friendly. Check state tax rules for pensions, 401(k)/IRA withdrawals and Social Security in our State Mini-Guides to retirement.

- Healthcare access: Proximity to hospitals/geriatrics matters. Every state has some metros with excellent healthcare better specialist access, usually in larger metros and university towns.

- Climate & weather risks: Florida and parts of Arizona have weather (heat, hurricanes, flood, wildfires) and insurance cost implications that can affect affordability and long-term livability.

- Community type — Active adult/55+ vs. mixed neighborhoods affect resale and lifestyle.

- Other factors – Traffic, crime, political environment, culture, transportation.

Bottom line — how to use this if you’re planning retirement now

- If your priority is low price / stretch your nest egg: start with Pennsylvania metros (Pittsburgh, Harrisburg, smaller Philly suburbs).

- If you want growth potential with reasonable stability: consider North Carolina suburbs around Raleigh/Charlotte (steady demand from employers).

- If weather/amenities matter (beach, sun, active lifestyle): Florida and Arizona have many lifestyle advantages but expect higher prices in coastal/resort areas — shop secondary metros for better deals. Most parts of Pennsylvania have ready access to many cultural advantages, but has the disadvantage (for many) of experiencing the coldest winters.

- Prices vary by area. Florida and Arizona offer lifestyle benefits but carry higher prices in popular areas — look to secondary metros for better value. Don’t forget that home prices vary tremendously by area – so don’t rule out a state just because of the statewide average.

Comments?

What are your thoughts about retirement real estate in your area. Are prices and demand going up, down, or sideways? Please let us know in the Comments section below.

Comments on "Retirement Real Estate: Which State is Best – Arizona, Florida, North Carolina, or Pennsylvania"