Arkansas Best Places to Retire – A Guide

Overall

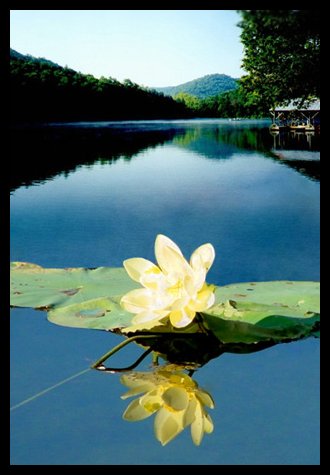

When it comes to the best places to retire, Arkansas, population 2.9 million in 2013, is a popular retirement destination for baby boomers because of its mild climate, beautiful scenery, and low cost of living. Many retire in Arkansas – the Natural state – because they have heard of the many active adult communities that cater to the over 55 crowd. The northwest part of the state near Fayetteville is one of the fastest growing regions in the U.S. The Wikipedia entry for Arkansas has more interesting facts, including further tax details. Update July. 2019.

Arkansas Climate

The Arkansas climate is humid subtropical, strongly influenced by the Gulf of Mexico. Summers are hot and humid with frequent thunderstorms and occasional tornados. Winters are milder in the south. January lows in the low 30’s and highs about 50.

Economy and Home Prices in Arkansas

Arkansas has one of the lowest per capita incomes (inflation-adjusted) – $20,300 – of any state. Median home prices are much less expensive than in the rest of the U.S. The Arkansas Zillow Home Value Index in mid 2019 was $126,600, about half the national Index. That Index for Bentonville (headquarters for Walmart) was $231,400. The median home in the Little Rock area sold for $143,900 in the 1st Quarter of 2019 (NAR). Arkansas’s cost of living is below the national average.

Arkansas Taxes

Tax Burden: Arkansas taxpayers have the 14th highest state/local tax burden of any state. They pay $3,351 per capita in state and local taxes.

Marginal Income Tax Rates. Arkansas has a 6.9% income tax on a top bracket that starts at $35,100. Total tax burden in Little Rock is about average, 8.1% compared to the median rate for large U.S. cities.

Retirement Income Exemptions. A law that went into effect in 2018 exempts military pensions from state taxation. Federal, state, and private pensions are not exempt, although there is a $6000 exemption. Up to $6000 in IRA distributions are exempt after age 59.5.

Social security exemption. Social security benefits are exempt.

Sales Tax: State sales tax is 6.5%. Cities and counties can add up to 5.5% on top of that. Food is taxed at 2%. and cities and counties can add up to 5.5% on top of that.

Property Taxes: Property taxes are relatively low, 35th in the U.S. The average property tax paid is $532 annually on a home worth just over $100,000.

Homestead Exemption. Arkansas has a homestead exemption for people over 65 – the taxable assessed value cannot increase above the previous year’s unless improvements have been made.

Estate and/or Inheritance Taxes. Arkansas has neither an inheritance nor a state tax.

Link to Arkansas Tax Department

Best retirement communities in Arkansas

Arkansas has many towns that are great as a retirement location; it is also has some of the largest and most successful planned retirement communities. One of the best places to retire in Arkansas is the college town of Fayetteville, home of the exciting University of Arkansas. Other great retirement communities are near Hot Springs, including the extremely large and popular Hot Springs Village. Bentonville, the home of Walmart, is a fast growing and interesting town. Hardy is a smaller town worth exploring. The state has many lakes as well as the Ozarks, a reason why it is a top retirement destination. Eureka Springs is another popular retirement community in Arkansas.

Certified Retirement Communities

Arkansas does not have a certified retirement community program.

At Topretirements.com our reason for being is to provide the practical facts and peer-reviewed profiles to help you choose the right retirement community. Here is more inside information on retirement living communities in the neighboring states to help you retire in Louisiana, Oklahoma, Texas, Tennessee,Alabama, and Mississippi. These links provide insight and data into economic conditions, climate, top communities, and taxes.

Get started with reviews of the best retirement towns in Arkansas in the right hand column.